High-accuracy signals from experienced analysts

Our signals are generated by seasoned traders using proven technical and fundamental analysis to ensure high reliability.

Signals for Forex, Stocks, Cryptocurrencies, Commodities.

Detailed guidance on entry price, stop loss, & take profit levels.

Join our strategic partnership and start shaping your future from today onward.

At EFD Group, we are a team of seasoned trading professionals, market analysts, and financial strategists dedicated to helping traders make informed and confident decisions. With years of real-world experience across forex, crypto, commodities, and indices, our experts bring a deep understanding of market behavior and trading psychology. We don’t just send signals — we deliver insights backed by data, strategy, and precision. Our mission is to empower both novice and experienced traders with accurate, timely, and actionable signals that drive real results. Integrity, transparency, and performance are the foundation of everything we do. When you follow our signals, you're backed by a team that’s committed to your success in the market — every step of the way.

We offer accurate, real-time trading signals backed by expert analysis. Whether you're a beginner or pro, our service includes clear trade setups, daily insights, and dedicated support to help you trade smarter with confidence.

Our signals are generated by seasoned traders using proven technical and fundamental analysis to ensure high reliability.

Our alerts are easy to follow for new traders yet sophisticated enough for professionals to integrate into advanced strategies.

Take your trading to the next level with EFD Group’s professional trading signals, designed to empower both beginner and experienced traders in the Forex and Cryptocurrency markets. Our expert team analyzes market trends, technical indicators, and global news to deliver high-accuracy, real-time buy/sell signals that help you make smart, timely decisions.

With EFD Group, you gain access to a curated list of trading opportunities across major currency pairs and popular cryptocurrencies.

Our signals include detailed information such as entry points, stop-loss, take-profit levels, and market direction—so you can trade with clarity and confidence.

Whether you prefer short-term trades or long-term investments, our signals are tailored to support scalping, swing trading, and position trading strategies. You can follow signals manually to mirror the trades of top-performing analysts in real time.

Our expertly crafted signals help you trade with precision and confidence by guiding you through every critical step of a trade—entry, exit, and risk management.

| Date | February 21 2026 |

|---|---|

| Instrument | NZD/USD |

| Direction | BUY |

| Call Duration | Short-Mid-Term |

| Execution Rate | 0.5974 |

| Take Profit | 0.6174 |

| Stop Loss | 0.5874 |

| Rating | 5 Star |

EFD Group shows how to look back in time through trading on a forex chart. EFD technical analysts utilize technical charts to predict future price movements. Our Clients with open and funded trading accounts get help from our technical analysis which increases the winning potential in the forex market. The technical analysis is done based on the information provided by forex charts. Future investment movements are anticipated through a technical analysis, which looks at historical market prices and technical indicators. They believe supply and demand forces in the specific security market cause short-term price fluctuations.

With little new news influencing gold markets today, let’s recap the key factors that pushed gold prices toward the remarkable level of $5,000 per ounce over the past year or two. Geopolitical Risk as a Major Driver Rising geopolitical tensions have been one of the strongest forces behind gold’s climb. Conflicts in the Middle East — including a direct naval clash between U.S. and Iranian forces near the Strait of Hormuz — sparked sharp rallies as investors sought safety in hard assets. Meanwhile, the breakdown of peace talks between Ukraine and Russia and the controversial U.S. capture of Venezuelan President Nicolás Maduro intensified fears and boosted demand for precious metals. Trade uncertainty also contributed. Policies under President Trump’s “America First” agenda — such as threats of 100% tariffs on Canada and renewed interest in acquiring Greenland — created economic instability, weakening confidence in stocks and bonds and driving capital into gold. Monetary Policy and Economic Uncertainty Domestically, turmoil around the Federal Reserve also affected sentiment. A criminal investigation into Fed Chair Jerome Powell raised doubts about the central bank’s independence and unsettled institutional investors. Additionally, softer-than-expected jobs data strengthened expectations of future rate cuts, making gold — which doesn’t pay interest — more attractive. However, when Kevin Warsh was nominated to replace Powell, markets briefly sold off as investors anticipated tighter policy under his leadership. Structural and Institutional Demand A key long-term factor has been strong institutional buying. Central banks — led by the **People’s Bank of China and the Reserve Bank of India — continued large-scale purchases of gold as they diversified away from U.S. Treasury holdings, adding well over 1,000 tonnes annually to their reserves. This consistent buying helps create a structural support level under prices. Gold-backed ETFs also saw record inflows in India and North America, adding steady demand. A newer trend has been large cryptocurrency firms purchasing physical bullion to back digital token reserves, adding another layer of institutional support. Market Fluctuations and Outlook Despite this strong rally, the market did experience pullbacks — most notably in February 2026 — when geopolitical risk premiums eased and technical market rebalancing prompted short-term selling. These declines were orderly and short-lived. Overall, institutional analysts remain positive about gold’s prospects. If ongoing fiscal imbalances, high global debt, and political fragmentation persist, many see the potential for gold to move even higher — with some forecasts suggesting levels in the $6,000–$7,000 range by late 2026.

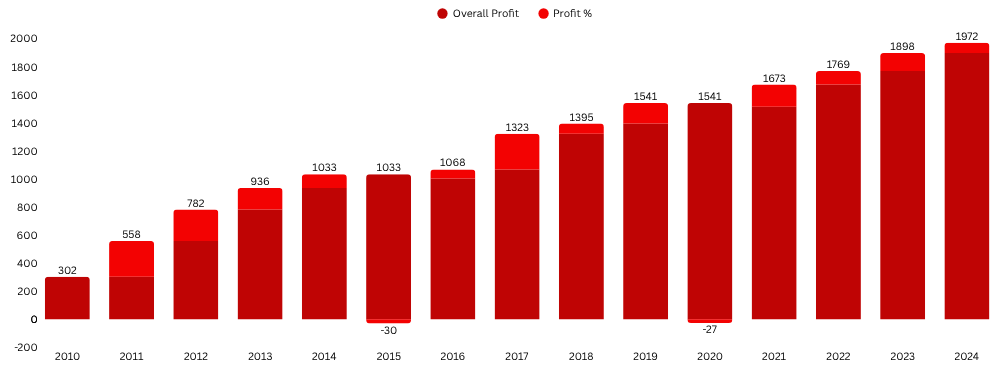

Since 2010, EFD Group has been delivering consistent, profitable results to traders worldwide. Our dedication to excellence and transparency has built a strong reputation and a loyal client base. Through market challenges, we’ve adapted quickly by refining our strategies and enhancing our services to ensure maximum efficiency and reliability. At EFD Group, we provide clear, comprehensive trading signals that give you a real edge in the markets.

At EFD Group, we offer accurate and timely trading signals across a wide range of financial markets, helping you seize opportunities no matter your trading style or preferred asset class.

Receive real-time signals for major and minor currency pairs including EUR/USD, GBP/USD, USD/JPY, and more. Our signals are backed by technical and fundamental analysis to help you navigate the world’s most liquid market with confidence.

Get strategic insights and trading signals for top global indices such as Germany 40 (DAX), US Tech 100 (NASDAQ), Wall Street 30 (Dow Jones), and S&P 500. Ideal for traders who want to capture market momentum or hedge broader portfolio exposure.

Explore high-potential opportunities in commodities markets including:Gold, Silver, Platinum,Crude Oil, Natural Gas, Sugar, Cocoa,Our commodity signals keep you informed on price swings driven by global demand, supply, and macro events.

Stay ahead in the crypto space with accurate and risk managed trading signals for Bitcoin, Ethereum, Litecoin, Ripple, and other top-performing altcoins. Ideal for both spot and derivative trading across the major platforms.

Working with EFD Group has been a game-changer. Their team is responsive, creative, and results-driven. From Google Ads to email campaigns, everything was managed flawlessly.

Shalini Verma

We were struggling to rank on Google—until we partnered with EFD Group. Their digital marketing expertise helped us increase visibility, improve engagement, and grow our sales online.

James Carter

The EFD team doesn’t just deliver services—they deliver strategy and vision. They understood our goals and tailored a marketing plan that actually worked. Highly recommended!

Neha Shah

EFD Group helped us launch our brand online from scratch. Their content strategy, social media management, and ad campaigns gave us a strong start. We felt supported every step of the way.

Vikram Chaudhary

Digital marketing made simple and effective—thanks to EFD Group. They explained everything clearly, created amazing content, and our traffic doubled in just a month.

Sophia Taylor

We have worked with many agencies, but EFD stands out. Their attention to detail, timely reporting, and focus on ROI make them a long-term partner for us.

Eric Johnson

Thanks to EFD’s digital strategies, we now get steady leads through Facebook and Google Ads. Their team knows what works and adapts fast to market changes.

Ritika Mehta

EFD Group transformed our online marketing game. From keyword research to visuals, they handled everything professionally. We saw a 40% increase in conversions.

Rahul Singh

An Ideal Plan For Beginners

Boost the potential of Earning

Go Elite & Master The Markets

You don’t need to follow our forex signals strictly. They’re trade ideas meant to guide you, so use them alongside your own strategy to maximize potential profits. The stop loss (SL) and take profit (TP) levels indicate the expected price range based on current trends, but if your analysis suggests more upside, feel free to raise or even remove the TP to capture greater gains.

Our signals are manually crafted by experienced analysts who apply a variety of trading strategies, unlike many providers who rely on automated systems. While both approaches have their strengths, as discussed in our article “Forex Signals – Auto vs. Manual,” we believe human insight offers a more valuable edge in the market.